Service standards strong during August

We reported in our July issue of Adviser Connect that we had made progress during the second quarter of this year, and with planned adjustments during July, we anticipated moving our service standards to where we want them to be.

We’re pleased to share that our service standards for August are looking strong across both our call centre and operations.

Call centre

This year, our call centre initiated a collaborative framework to coordinate our engagement specialists based on call type and complexity. This approach not only enhances our ability to handle call and chat volumes but also ensures that calls are routed to the appropriate knowledge base.

In July, we moved some of our up-skilled staff from the Simple Insurance tier (or queue) to bolster the support provided to complex insurance and super & investments queries. This has improved our call wait times - for the first two weeks of August, our performance was below or close to our target average wait time of 3 minutes.

August 2023 (first two weeks) – Average wait time for calls - across Australasia

|

Service Tier |

Average wait time (minutes) |

|

Simple Insurance |

2 minutes and 12 seconds |

|

Complex Insurance |

3 minutes and 33 seconds |

|

Super & Investments |

2 minutes and 30 seconds |

*Combined for both advisers and customers

Operations

In addition to the making improvements to our call centre, we’ve focused on streamlining our administrative processes and implementing automation to improve our speed and capacity.

Transaction Backlog

August saw us clear our insurance transactions backlog. We’ve reduced the backlog for super & investments by 65% since the start of 2023 and are on track to clear it by the end of the quarter.

New transaction processing

We’re happy to report that we met our service standard (85%*) for most transaction types during the first two weeks of August. The only exception was non-financial transactions for super & investments – but that’s improving, and we should reach our target during this quarter.

|

Transaction Type |

Service Standards* |

|

|

Insurance |

Super & Investments |

|

|

Financial |

86% |

86% |

|

Non-financial |

86% |

74% |

*Service Standard – percentage of transaction processed within days: Financial, 3 Days; Non-financial, 5 Days.

My Resolution Life fixes – August summary

We’ve rounded up the latest changes we’ve made to My Resolution Life below.

Some of the changes below will require you to search for the customer policy and access Customer View in My Resolution Life. If you need help with searching for your customers, visit the My Resolution Life help centre.

|

What’s different? |

Where will you or customers see this in My Resolution Life? |

|

When you or customers update their address, the following fields must now be completed before hitting submit:

This ensures we have all the details we need from you or customers to efficiently update the address on record. |

To update the customer’s address: 1. Login to My Resolution Life, and search for the customer policy to access Customer View. 2. Once in Customer View, on the left-hand side menu, select My profile > Address details. 3. Simply complete the form and all mandatory fields and select Update. |

|

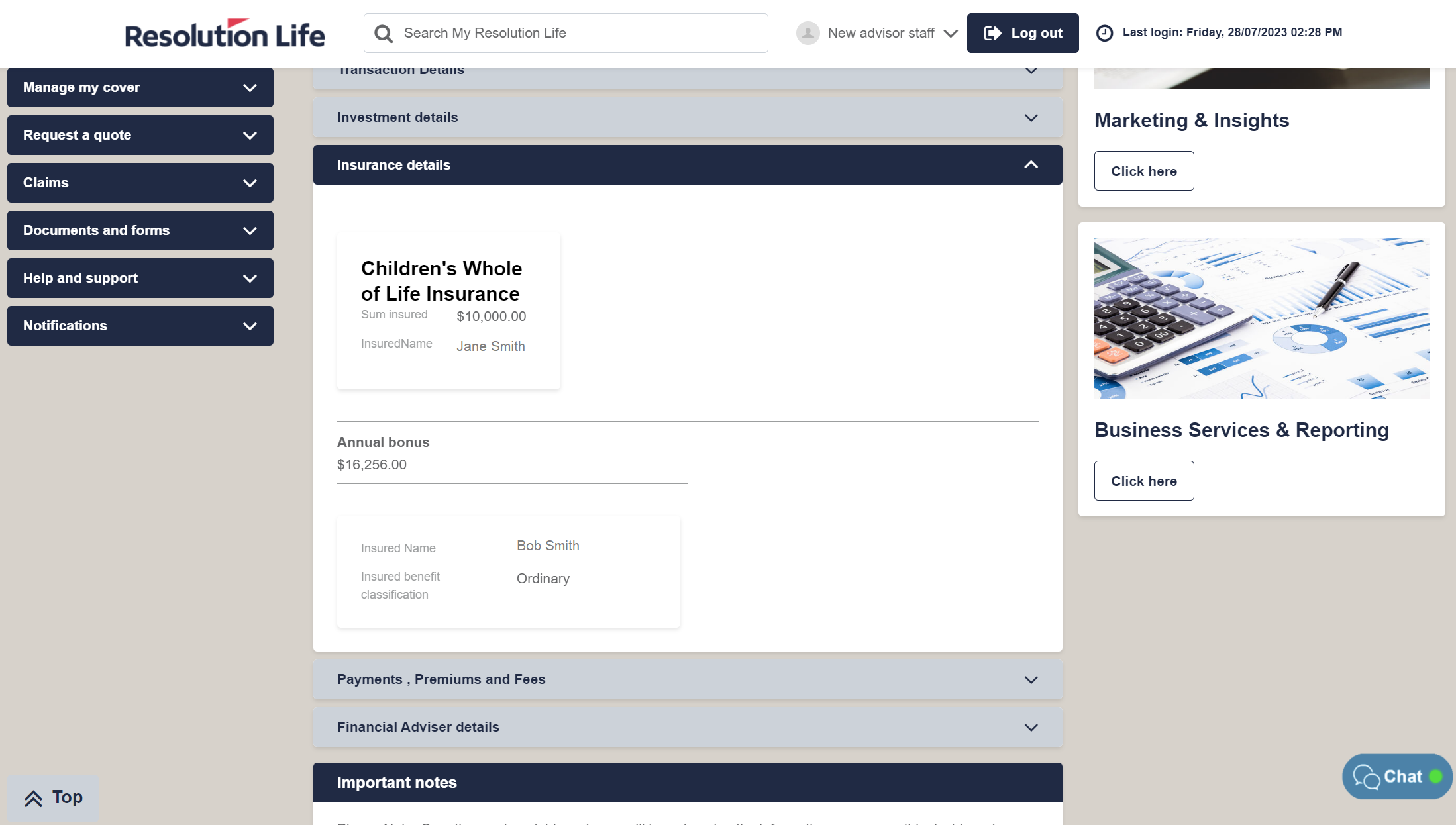

When viewing a customer’s policy information, the customer names are now displayed against the benefits in the Insurance details section. This will make it easier for you and customers to know which benefit applies to which person on a policy, especially when there is more than one life insured. |

1. Login to My Resolution Life, and search for the customer policy to access Customer View. 2. Once in Customer View, scroll down and click on Insurance details to expand the tab. You’ll have the below view, as an example:

|

|

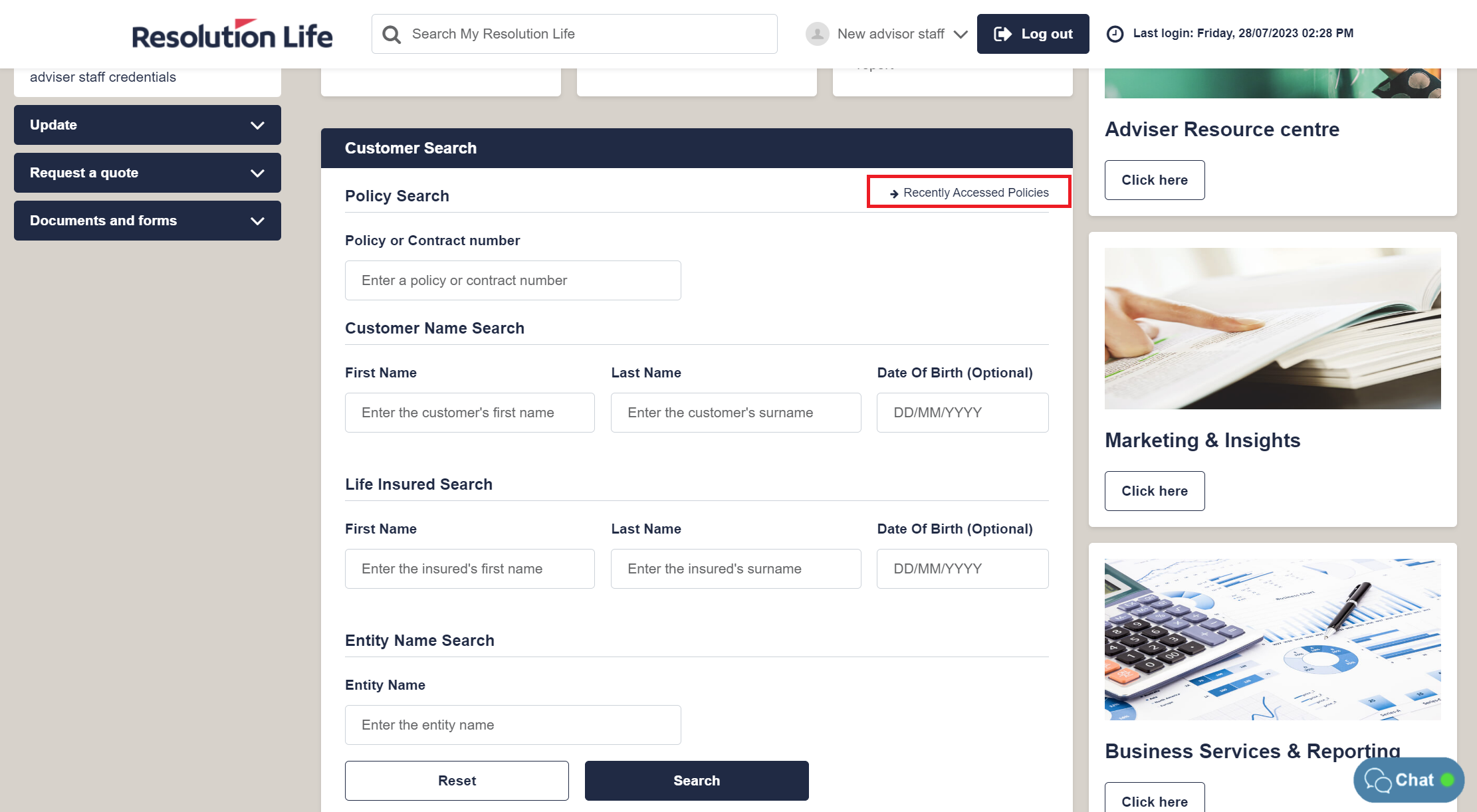

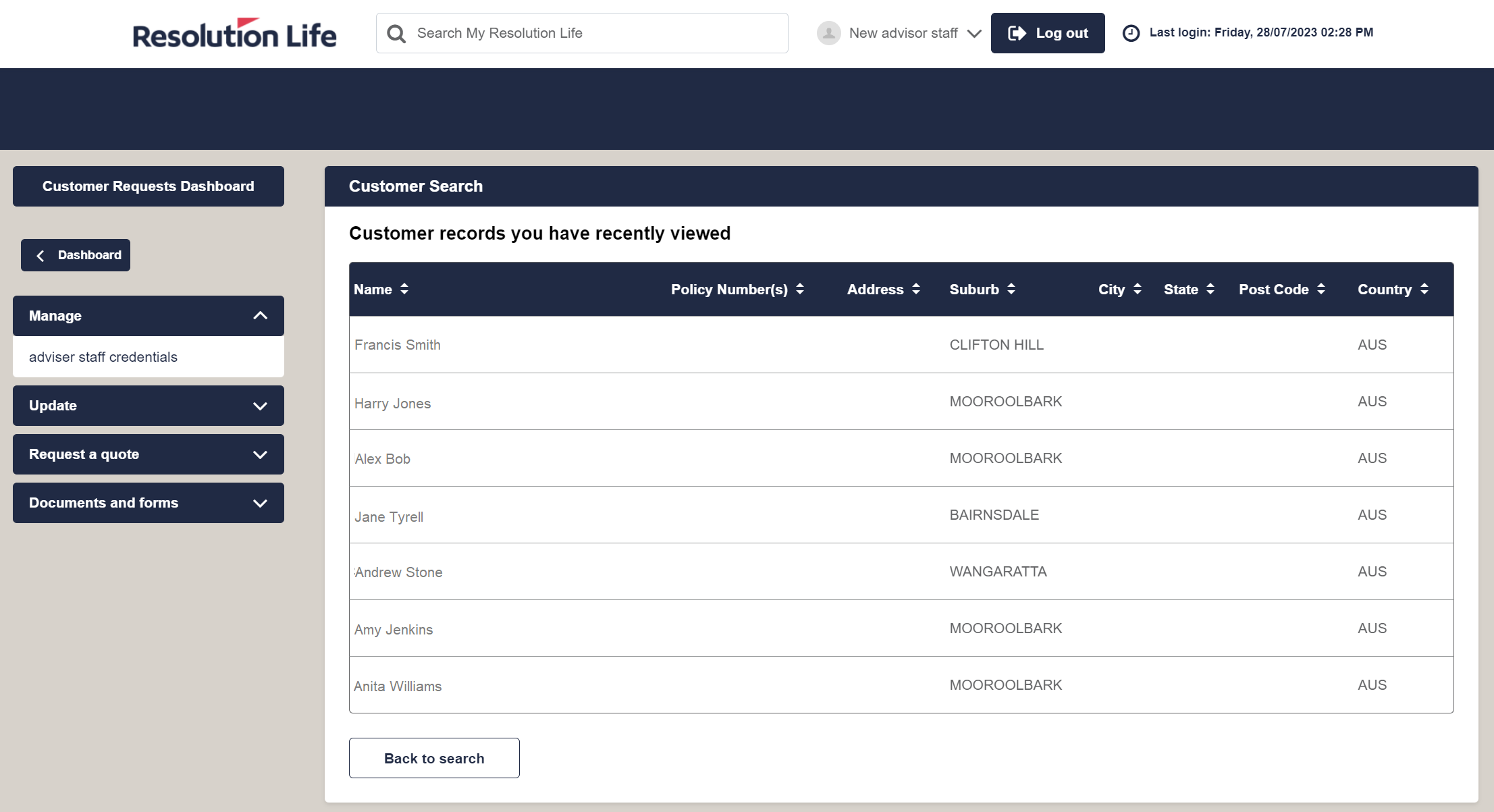

You can now view a list of the policies you recently accessed, without having to search for them again. |

1. Once you have logged in to My Resolution Life, under Customer Search, select Recently Accessed Policies. 2. You’ll be taken to a page with a list of policies you previously accessed:

|

|

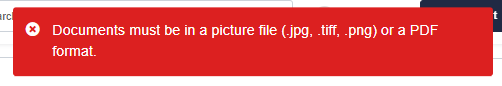

When submitting the Contact Us form in the portal, you’ll immediately see an error notification if we cannot accept the file type that you’ve attached to your request. Ensuring you attach acceptable file types to your request helps us in processing your request efficiently. Please note, we can only accept the following file types: .jpg, .tiff, .PNG or PDF. For security purposes, we can’t accept .docx or .doc. |

To access the Contact Us form: 1. Login to My Resolution Life, and search for the customer policy to access Customer View. 2. Once in Customer View, on the left-hand side menu, select Help and Support > General enquiry. If you complete the form and attach an unacceptable file type, you’ll see this error message:

|

Important information

Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life). The content on this website is for information only. The information is of a general nature and does not constitute financial advice or other professional advice. Before taking any action, you should always seek financial advice or other professional advice relevant to your personal circumstances. While care has been taken to supply information on this website that is accurate, no entity or person gives any warranty of reliability or accuracy, or accepts any responsibility arising in any way including from any error or omission.

A disclosure statement is available from your Adviser, on request and free of charge.